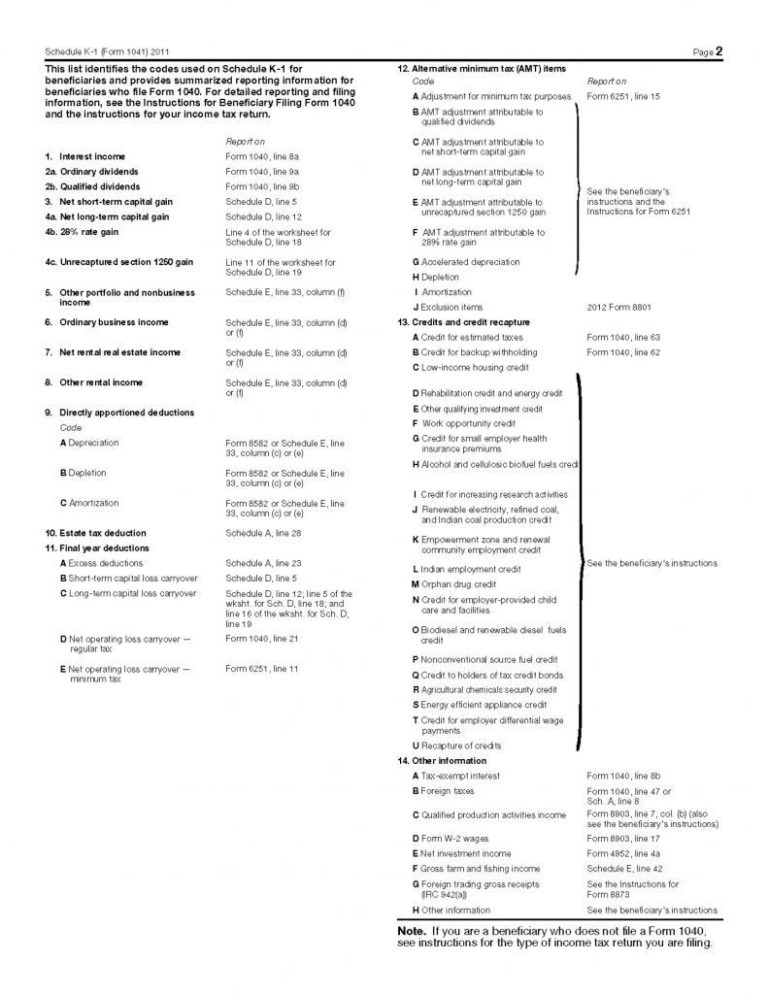

Calculating the capital gains 28% rate. Of the gain, • ²⁄ 3 of any section 1202 exclusion you reported in column (g) of form 8949, part ii, with code "q" in column (f), that is 60% of the gain.

C2a68dd89a jan 5, 2021 — if there is an amount in box 2d, include that amount on line 4 of the 28% rate gain worksheet in these instructions if you complete line 18 of.

28 rate gain worksheet. March 14, 2019 by leo garcia. Comparing mitosis and meiosis worksheet jan 25, 2021 | victorina lina. Regular 28 rate gain worksheet is an easy financial manager device that may be use both electronic or printable or google sheets.

Color by number worksheets for kindergarten jan 23, 2021 | josephine cléo. To view the tax calculation on the. Adhere about what to edit to the instructions.

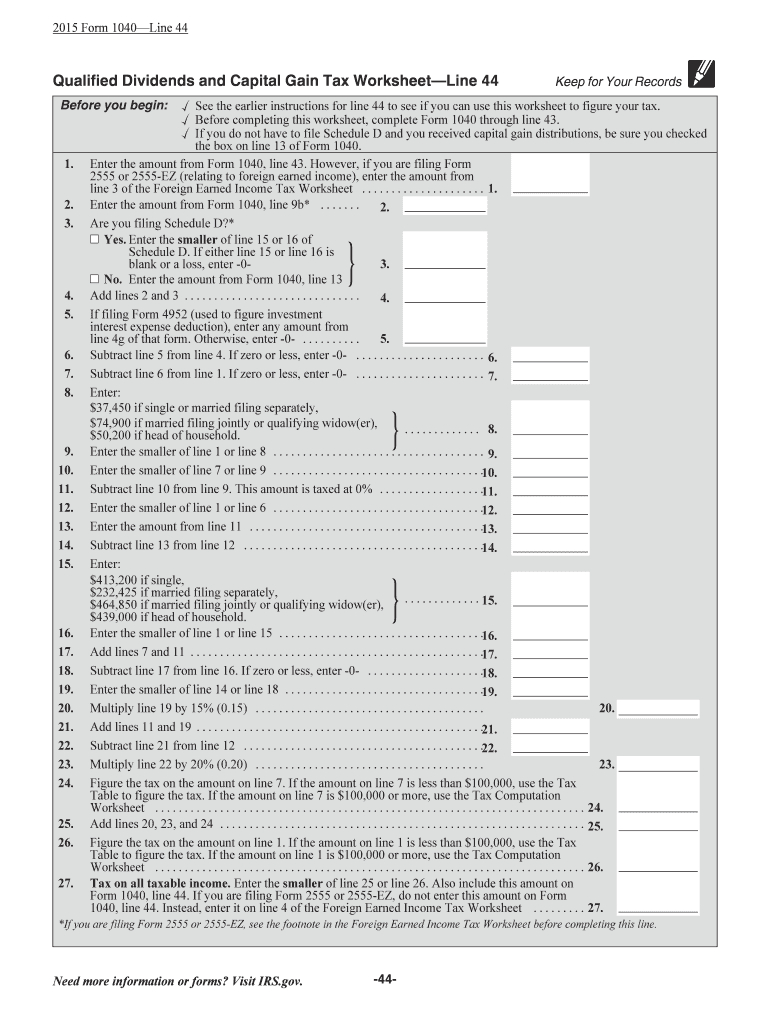

If the result is a gain, it must be reported on line 13 of the 1040 form. 28% rate gain worksheet or qualified dividends and capital gain tax worksheet, if they apply. Form 8949 part ii includes a section 1202 exclusion from the eligible gain on qsb stock, or

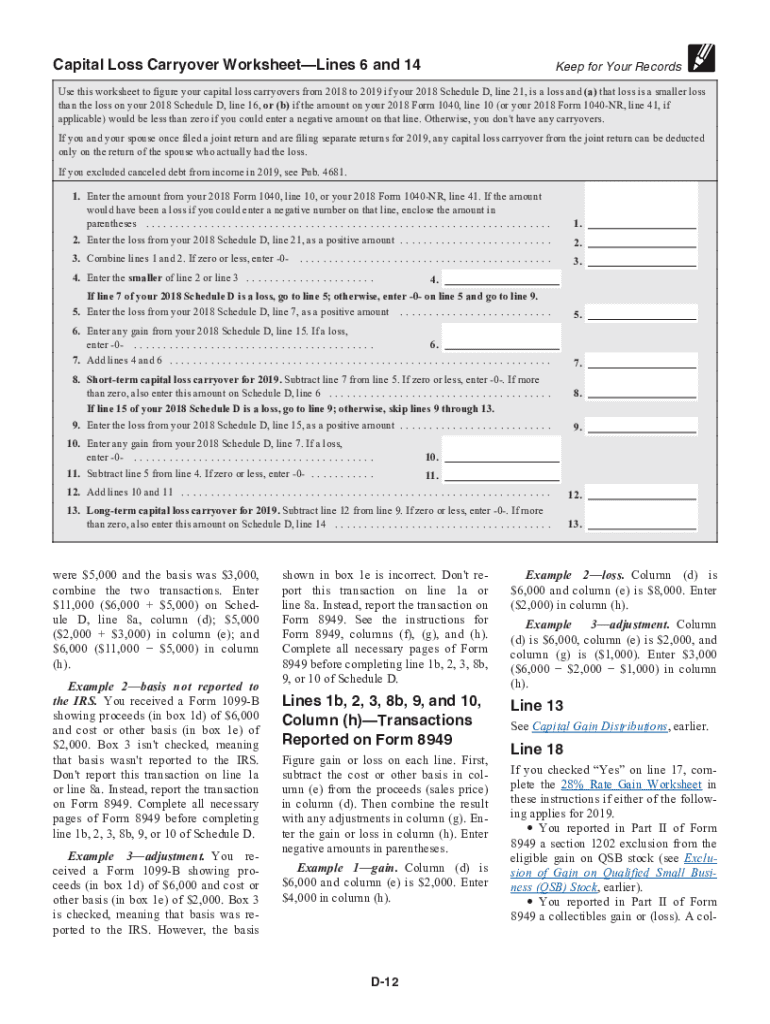

You will need to complete the 28% rate gain worksheet in the schedule d instructions. If you had any section 1202 gain or collectibles gain or loss enter the total of lines 1 through 4 of the 28 rate gain worksheet. You will need to complete the 28% rate gain worksheet in the schedule d instructions.

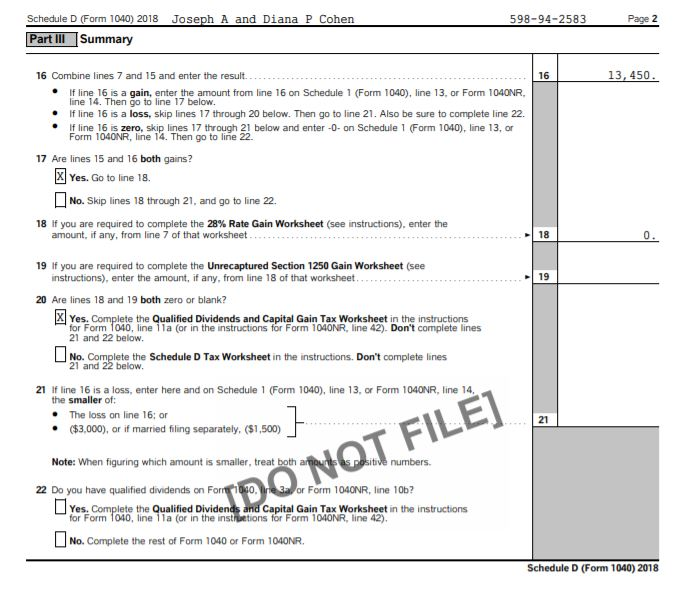

Monique moore on ##top## 28 rate gain worksheet irs. Per the instructions, the 28% rate will generate if an amount is present on schedule d, lines 18 or 19. If lines 18 or 19 have amounts then line 20 will check the box no and complete the schedule d tax worksheet which goes through the various tax rates (15%,…

If you checked yes on line 17, complete the 28% rate gain worksheet in these instructions (page 10) if either of the following applies for 20xx: Skip lines 18 through 21, and go to line 22. The remaining gain is taxed at a 28 percent rate.

The 28 rate gain worksheet is definitely a product that we have not seen before. 3rd grade grammar worksheets mar 02, 2021 |. If there is an amount on line 18 (from the 28% rate gain worksheet) or line 19 (from the unrecaptured section 1250 gain worksheet) of schedule d (form 1040) capital gains and losses, according to the irs, the tax is calculated on the schedule d tax worksheet instead of the qualified dividends and capital gain tax worksheet.

If there is an amount in box 2d, include that amount on line 4 of the 28% rate gain worksheet in these instructions if you complete line 18 of schedule d. 28 rate gain worksheet desiree naomie march 2 2021 worksheets number as the student learns to write meaningful sentences in the beginner phase he gets to know about the usage and organization of paragraphs in the more advanced levels. Form 8949 part ii includes a section 1202 exclusion from the eligible gain on qsb stock or.

You will need to complete the 28% rate gain worksheet in the schedule d instructions. If you received capital gain distributions as a nominee (that is, they were paid to you but actually belong to someone else), report on schedule d, line 13, only the amount that belongs to you. Form 8949 part ii includes a section 1202.

If there is an amount in box 2c, see exclusion of gain on qualified small business (qsb) stock, later. The corrected worksheet results in a lower regular tax for most taxpayers and a higher regular tax for a small number of taxpayers. Lacerte calculates the 28% rate on capital gains according to the irs form instructions.

28 rate gain worksheet mar 02, 2021 | desiree naomie. Enter the amount, if any, from line 7 of the 28% rate gain worksheet in the instructions. If the result is a gain, it must be reported on line 13 of the 1040 form.

You will need to fill out the 28% rate growth worksheet in the d planning instructions. Clude that amount on line 4 of the 28%. 28 rate gain worksheet mar 02 2021 desiree naomie.

If the result is a gain, it must be reported on line 13 of the 1040 form.

28 Rate Gain Worksheet 2016 with Eur Lex R2447 En Eur Lex

28 Rate Gain Worksheet 2017 worksSheet list

28 Tax Gain Worksheet Worksheet Resume Examples

Instructions For Schedule D Form 1040 Or 1040 SR, Capital

1040 28 Rate Gain Worksheet Worksheet Template Design

Qualified Dividends and Capital Gain Tax Worksheet 2019